Australia inflation 2025 hit its lowest in four years as CPI fell to 2.1% in Q2—fueling expectations of an RBA rate cut. Here’s what it means.

Australia inflation 2025: There are lots of things which is changing in the Australian economy–and this time, it’s not another hike. Inflation has gradually stopped, with the Consumer Price Index (CPI) reaching 2.1% year-on-year for June 2025. It’s a big change in recent months and the lowest in four years. Here, in this article, we will see what it means for every Australian and the Reserve Bank of Australia (RBA). Let’s see a detailed analysis.

What Are Numbers Saying: Australian inflation in 2025

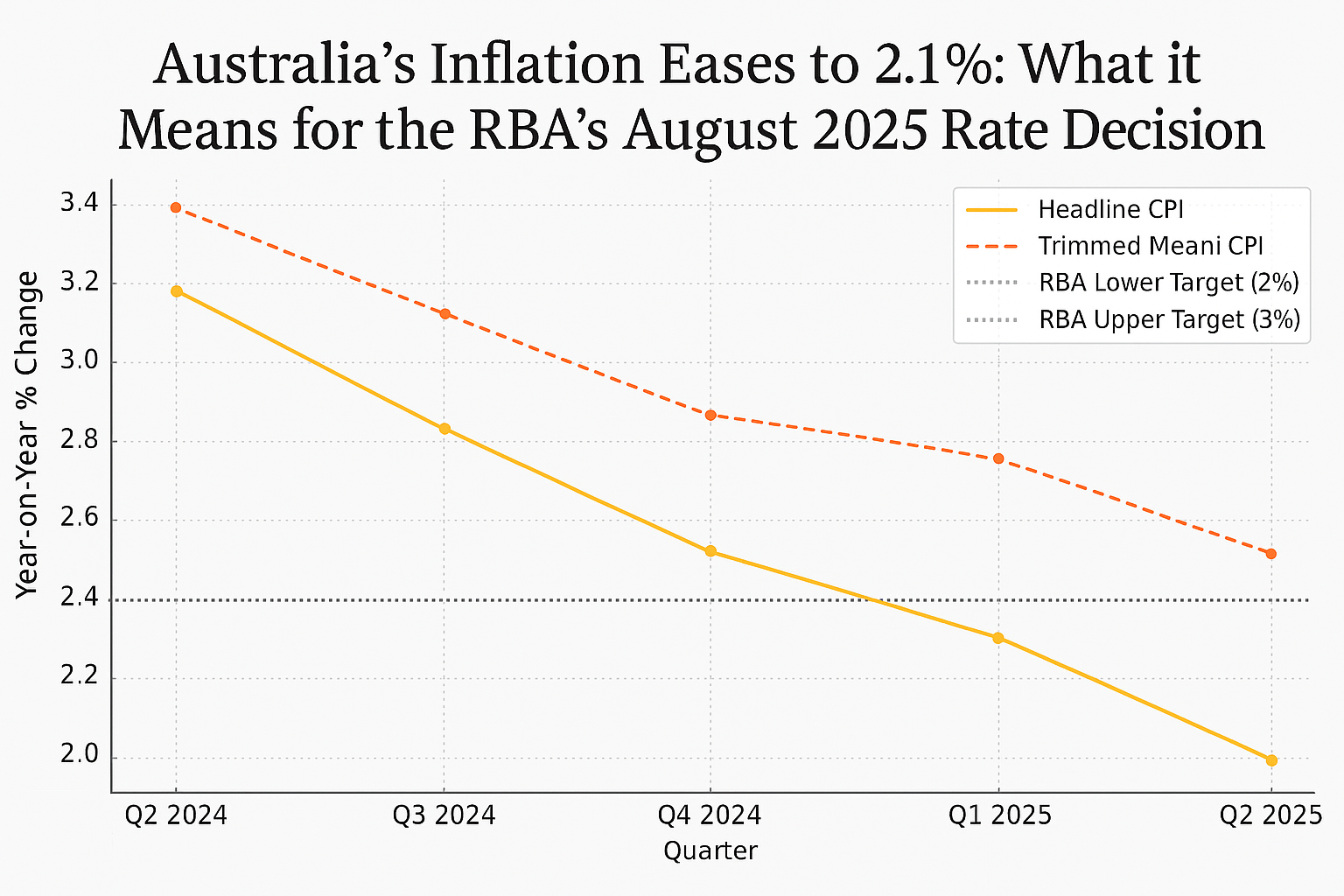

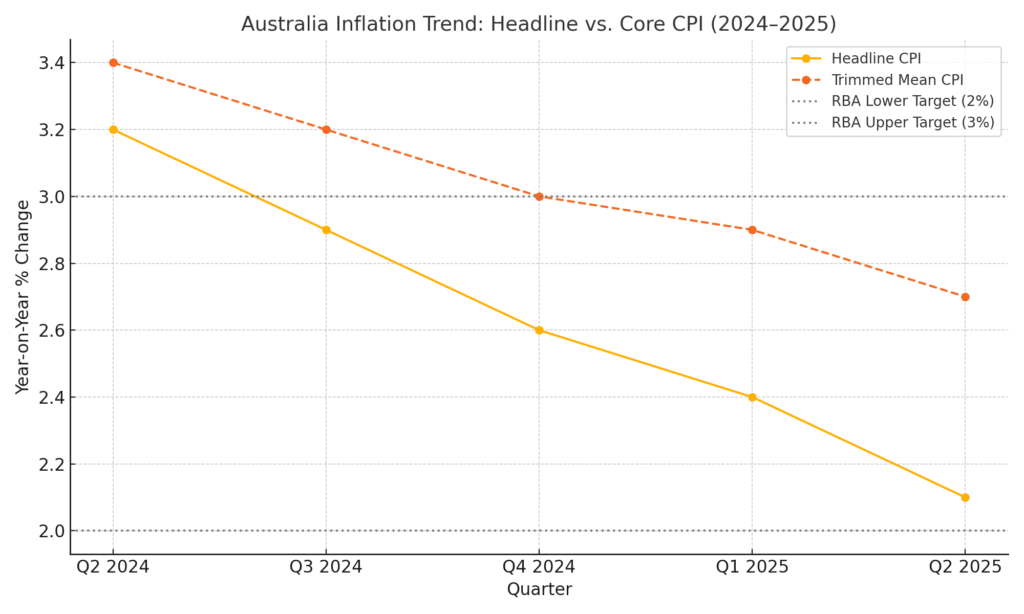

According to the Australian Bureau of Statistics, headline inflation has dropped to 2.1%, while the trimmed mean (a more stable measure) is down to 2.7%. Both numbers are now sitting comfortably inside or just around the RBA’s 2–3% target zone.

As per as Australian Bureau of Statistics, the total inflation has dropped 2.1%, while a more consistent measure is down to 2.7%. Both the numbers are nice but close to the RBA’s 2-3% target Zone.

Australian inflation in 2025: Let’s see what is behind these numbers?

Goods are getting Cheaper: Fuel prices dropped by 10%, then it helped bring overall goods inflation down to just 1.1%. Apart from this, constructing new houses has also become cheaper.

Services are easing too: Rent is not rising quickly, and insurance costs are slowing down. Some extra support from the government, like Commonwealth Rent Assistance, helps lots of families.

Impact of the Government’s help: The Government helps in many things, such as bill discounts on energy, rent help it is important for the government to help keep inflation low. If the government didn’t help, then it would increase by 5.7%.

Still, there is some Bad News: Grocery bills are still high, basic things like eggs and coffee have increased, eggs by 19% and coffee by 9%, because of global supply and bird flu issues.

Australian inflation in 2025: What’s the point of view of RBA?

So, now the main question: will the RBA finally start cutting interest rates?

In July 2025, the cash rate is still 3.85%, which is lower in the last year, which was 4.35%, but still high. As inflation goes down, there is a high chance rates to drop, but there is no worry about it because central banks make decisions very careful and well-researched way.

Here’s the deal:

- Inflation is at the target level—for now.

- GDP growth is growing slowly, just by 1.3%. It means people don’t spend too much

- Unemployment is creeping up to 4.3%, the highest since early 2022.

RBA Governor Michele Bullock isn’t making any quick moves. The RBA didn’t cut rates in July; it surprised markets. Why? They’re still worried service inflation might stay high for a while. And there’s a bit of global uncertainty too—like possible U.S. tariffs which could shake things up.

Looking Ahead: Is a Cut Coming?

Most economists say yes, and soon, Australia’s inflation will reach 2025

- A Reuters poll found that 31 out of 37 economists expect the RBA will cut rates in August by 25 basis points, bringing the cash rate down to 3.60%.

- More cuts might follow, with the rate down to 3.10% by the end of 2025.

RBA wants a soft landing, which brings the inflation down without harming the economy. They’re getting close, but not quite there yet. With household spending still low, it’s a tough job that needs to be managed carefully.

It’s important to watch carefully how the government helps, like subsidies. Once it ended, the prices started to increase again. As per some experts, RBA will move slowly and continuously even if the current numbers look good.

Australia inflation 2025: The Bigger Picture

Let’s zoom out for a second. What does it mean for an average Australian?

- Inflation, prices stay low, and loan rates drop, so people might feel like their money goes further.

- Lower rates could also give a boost to housing, retail, and consumer confidence.

- But external shocks—like energy prices or geopolitical issues—could still shake things up.

There’s also a wider debate brewing. According to some economists, we should focus on overall income growth instead of only inflation. It gives more flexibility to support getting jobs and wages.

Conclusion : Australian inflation in 2025

As inflation decreased to 2.1%, which looks better. The RBA has some space to cut rates, and lots of people think it will happen soon. But the Central bank is taking time, and rightly so. The economic recovery is still weak, and last things could do more harm than good. A soft recovery is possible, but it’ll take steady hands, caution, and a close watch on what’s happening across the globe. Looking at the Australian inflation in 2025, it may continue if the current policy and trend hold.

Reference for more knowledge

- Visit ABS Official CPI Data for the full report.

- Compare with the US Inflation 2025 Outlook.

- Related: Japan Monetary Policy Trends.