Here, we present some top metal stocks in India for future growth. We see an in-depth analysis of copper, zinc, and aluminum for investors

The Indian Metal Sector plays a crucial role in the development of the country’s infrastructure, manufacturing, and exports. With the government’s push for infrastructure, growing demand for automobiles, renewable energy projects, housing, and electric vehicle adoption, the demand for various types of metals, such as copper, Zinc, aluminum, and steel, is very high. In the long term, the right metal stocks show both stability and good returns over the years.

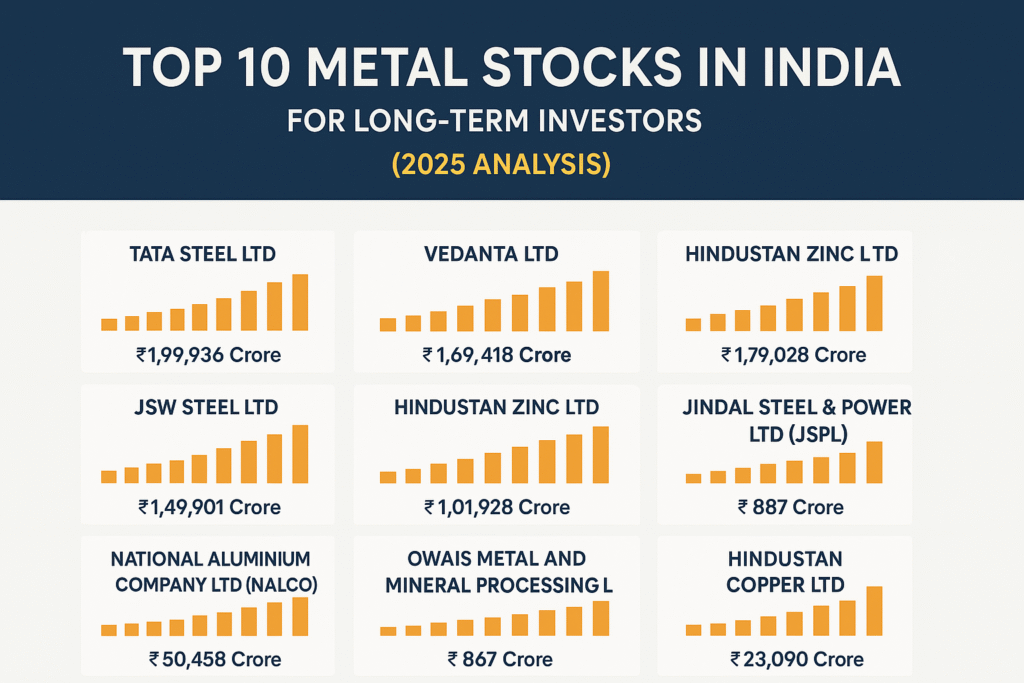

In this article, we examine the top 10 metal stocks in India for 2025, which are worth considering for long-term portfolios, based on their growth potential, market position, and fundamentals.

Overview of the Indian Metal Sector

Metals play a very important role in India’s industrial growth, with steel, aluminium, and copper standing as the most significant. India ranks as the world’s second-largest crude steel producer, recording an output of 143 million tonnes (MT) in FY24. The industry benefits from plentiful resources such as iron ore and coal, coupled with an efficient and cost-effective workforce.

Additionally, supportive government policies such as the Production-Linked Incentive (PLI) scheme and large-scale infrastructure spending have strengthened the industry’s growth. The domestic steel consumption is expected to expand by 9-10% in FY25, driven by robust demand from construction, automotive, and capital goods.

Why Invest in Metal Stocks?

With global demand for metals on the rise, companies in the steel, aluminum, and copper production industries are steadily expanding. This means investing in metal stocks can provide several benefits, including:

Long-Term Demand: Metals are essential to a wide range of industries, ensuring steady consumption for years to come.

Dividend Potential: Leading Companies such as Hindalco, Vedanta, and Tata Steel frequently distribute dividends, providing additional income.

Inflaton Hedge: With their intrinsic value, metals serve as a safe asset of wealth during periods of inflation rises.

Government Support: Initiatives such as the Production-Linked Incentive (PLI) scheme actively promote investment in domestic metal production.

Tata Steel Ltd

Tata Steel is one of the biggest producers in the world, and it has a strong global presence and a robust domestic market share. It specializes in suitable production, operational efficiency, and high-margin value-added products.

Market Cap (2025) – ₹ 1,99936 Crore

JSW Steel Ltd

JSW Steel is one of the top Indian steel manufacturers and the flagship company of the US$23 billion JSW Group. It is one of the fastest-growing steel companies globally. It operates in more than 100 countries. It is known for its high-quality special steel products catering to various industries, along with its strong focus on sustainability and innovation.

Market Cap (2025) – ₹ 2,56,320 Cr

Hindalco Industries Ltd

Hindalco Industries, part of the Aditya Birla Group, is a major aluminum and copper producer with a significant global presence through its subsidiary, Novelis. Serving sectors such as automotive, construction, and packaging, Hindalco focuses on sustainability, energy efficiency, and recycling as key drivers to enhance its production capacity.

Market Cap (2025) – ₹ 1,49901 Crore

National Aluminium Company Ltd (NALCO)

National Aluminium Company Limited (NALCO), a government-owned enterprise, operates across the entire aluminium production, from bauxite mining and alumina refining to power generation. The company prioritizes energy-efficient processes and exports aluminium worldwide. At the same time, its ongoing projects focus on improving production capacity and expanding into new markets.

Market Cap (2025) – ₹ 34261 Crore

Steel Authority of India Ltd (SAIL)

Steel Authority of India Limited (SAIL), a Maharatna Central Public Sector Enterprise, stands as India’s largest steel producer in the country. The company operates five integrated steel plants and three special steel plants, primarily located in the eastern and central regions of India, and is well-known for manufacturing and selling steel products.

Market Cap (2025) – ₹ 50458 Crore

Vedanta Ltd

Vedanta Ltd is a diversified natural resources conglomerate. It engages in the production of zinc, lead, silver, copper, aluminium, and power generation. The company pursues growth through strategic acquisitions and the advancement of new technologies. Vedanta is balancing economic progress with environmental sustainability.

Market Cap (2025) – ₹ 1,69418 Crore

Hindustan Zinc Ltd

Hindustan Zinc Ltd, a subsidiary of Vedanta Ltd, holds a leading position in the Indian zinc, lead, and silver market. In Q2 FY2024, the company recorded a 35% rise in net profit, which is higher due to zinc prices and increased demand. It continues to enhance its market presence through sustainable mining practices and capacity production initiatives.

Market Cap (2025) – ₹ 1,79028 Crore

Jindal Steel & Power Ltd (JSPL)

Jindal Steel and Power Ltd ranks among India’s leading steel producers, it has a strong presence in both steel and mining. The group has a global presence through its subsidiaries, operating across countries Australia, Botswana, Mauritius, Mozambique, Indonesia, Madagascar, South Africa, Tanzania, Namibia, and Zambia.

Market Cap (2025) – ₹ 1,01928 Crore

Owais Metal and Mineral Processing Ltd

Owais Metal and Mineral Processing Ltd specializes in refining and trading a variety of metals and minerals for manufacturing and construction. The company is steadily expanding its supply chain, focusing on cost-effective production and operational efficiency.

Market Cap (2025) – ₹ 867 Crore

Hindustan Copper Ltd

Hindustan Copper Ltd is the only company in India with a fully integrated copper producer, managing the entire value chain from mining and ore beneficiation to smelting and refining. The company is actively expanding its operations, attracting major industry players such as Adani Enterprises and Hindalco to its upcoming copper mining projects.

Market Cap (2025) – ₹ 23090 Crore

Conclusion

The Metal Sector in India provides the best opportunities in the long term, especially after the government scheme and developed infrastructure. These companies are showing strong growth and potential to grow more. Their stock shows strong potential growth; however, before taking any investment decision, do proper analysis before investing.

Also Read : Hindustan Zinc Ltd share price Target 2025, 2026, 2027 to 2030